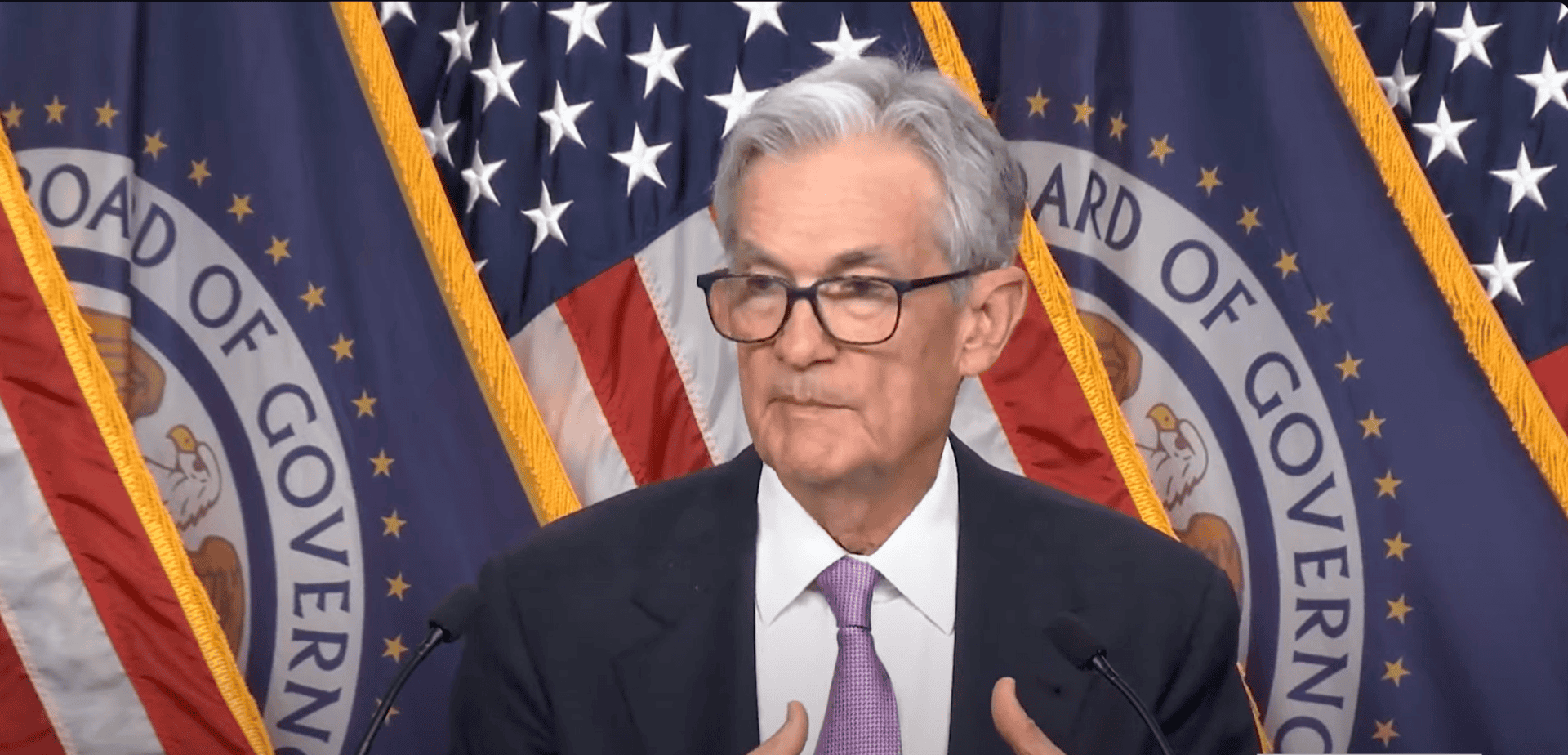

The recent decision by the U.S. Federal Reserve to reduce interest rates by 0.50%, marking its first rate cut in four years, has sparked considerable discussion and speculation among investors globally. This decision is particularly significant for emerging markets like India, where the stock market is deeply interconnected with global financial movements. Understanding the possible implications of this rate cut on the Indian stock market requires an exploration of several factors, including market sentiment, foreign investment, exchange rates, and sectoral impacts.

The Global Economic Context: Fed Rate Cut

The Federal Reserve’s decision to cut rates typically signals a response to either economic slowdowns or inflationary pressures. In this case, the U.S. economy may be showing signs of cooling down, prompting the Fed to lower borrowing costs to encourage spending and investment. For the past few years, the Fed had maintained a steady rate, and this 0.50% reduction is significant as it suggests a shift in U.S. monetary policy.

A reduction in interest rates in the U.S. often leads to cheaper borrowing costs, which can stimulate economic activity domestically. However, it also influences international capital flows, with investors seeking higher returns in foreign markets when the yield on U.S. assets declines. This aspect is crucial for India, as the country’s stock market is sensitive to the inflows and outflows of foreign capital.

Impact on Indian Stock Market

1. Foreign Institutional Investments (FII) Inflows

One of the most immediate effects of the Fed rate cut is the potential increase in Foreign Institutional Investments (FIIs) into emerging markets like India. When interest rates in the U.S. drop, it reduces the returns investors can earn on U.S. Treasury bonds and other fixed-income securities. Consequently, global investors often look for better returns in riskier but higher-growth markets, such as India.

Historically, Indian equity markets have seen strong inflows from foreign institutional investors during periods of low U.S. interest rates. This is because Indian assets, particularly stocks, offer attractive yields relative to U.S. assets in such environments. With the Fed’s 0.50% rate cut, it’s reasonable to expect that more global funds will flow into Indian stocks, pushing the indices higher.

Additionally, India’s strong macroeconomic fundamentals, including a high GDP growth rate relative to many developed markets, make it an appealing destination for foreign investors. This renewed foreign interest can lead to bullish trends in the Indian stock market in the short to medium term.

2. Exchange Rate Implications

A Fed rate cut often results in a weakening of the U.S. dollar, as lower interest rates make dollar-denominated assets less attractive. In contrast, currencies of emerging markets, including the Indian rupee, may strengthen as foreign inflows increase.

A stronger rupee can have mixed effects on the Indian stock market. On one hand, a stronger currency can reduce the cost of imports, benefiting industries that rely heavily on imported raw materials, such as the manufacturing, automobile, and technology sectors. These sectors may see a positive impact on their profit margins, potentially leading to stock price gains.

On the other hand, export-oriented industries such as IT services and pharmaceuticals, which earn a significant portion of their revenues in foreign currencies, could face headwinds. A stronger rupee reduces the value of foreign earnings when converted back to Indian currency. This could dampen the stock performance of large Indian exporters, particularly in the IT and pharmaceutical sectors.

3. Interest Rate Dynamics in India

The Reserve Bank of India (RBI) keeps a close watch on global economic trends, including interest rate changes by major central banks like the Fed. The RBI’s own monetary policy may be influenced by the Fed’s decision. While the Indian central bank operates independently, a U.S. rate cut could give the RBI more room to cut interest rates domestically to support growth without fearing capital outflows.

Lower interest rates in India would reduce borrowing costs for businesses, leading to potential growth in corporate investments and expansion. Sectors such as real estate, infrastructure, and capital goods, which are highly sensitive to interest rate changes, could benefit from lower borrowing costs, driving stock prices up.

Additionally, a lower interest rate environment could encourage retail participation in equity markets, as fixed-income instruments like bonds and savings accounts become less attractive. This shift could further fuel a stock market rally in India.

Sector-Specific Impacts

1. Banking and Financial Services

The banking sector could see a dual impact from the Fed rate cut. On one hand, banks that have exposure to foreign debt or foreign currency loans may benefit from the increased inflow of capital. Additionally, banks that rely on foreign borrowings may find it easier to access cheaper capital, boosting their profitability.

On the other hand, a rate cut in India (if influenced by the Fed’s move) might squeeze the margins of Indian banks, particularly in their lending operations. However, this could be offset by an overall increase in economic activity, boosting demand for loans.

2. Information Technology (IT)

As mentioned earlier, the IT sector might experience some headwinds due to a stronger rupee, which would reduce the value of their dollar-denominated revenues. However, the potential increase in foreign investment into the broader Indian market might still lift IT stocks in the short term, particularly if the U.S. economy remains stable and the demand for Indian IT services remains high.

3. Automobiles and Manufacturing

These sectors, which depend heavily on imports for raw materials, stand to benefit significantly from a stronger rupee. A decrease in input costs can improve profit margins and support higher stock prices. Additionally, cheaper borrowing costs could incentivize expansion and capacity-building within these sectors.

4. Real Estate

Real estate, a sector highly sensitive to interest rate movements, could see a surge in demand if both the Fed and the RBI reduce rates. Lower interest rates make home loans more affordable, encouraging homebuyers and investors to increase spending in real estate. This could lead to higher valuations in real estate stocks.

Potential Risks and Uncertainties

While the Fed rate cut generally signals good news for emerging markets like India, there are potential risks. Global economic conditions, geopolitical uncertainties, or a downturn in the U.S. economy could lead to volatility in Indian markets. Additionally, any abrupt reversal of the Fed’s policy could result in sudden capital outflows, negatively impacting the Indian stock market.

Moreover, while foreign inflows may increase in the short term, sustained performance will depend on the Indian economy’s ability to absorb this capital effectively. Any economic or political disruptions domestically could temper the expected gains.

Conclusion

The Fed’s 0.50% rate cut marks a significant shift in global monetary policy, and its impact on the Indian stock market is expected to be largely positive in the short to medium term. Increased foreign inflows, coupled with potential rate cuts by the RBI, could provide a strong boost to equity markets. However, sectoral impacts will vary, with some benefiting from a stronger rupee and cheaper borrowing costs, while others, like IT, may face challenges due to reduced foreign earnings.

As always, investors should remain cautious of broader global trends and maintain a diversified portfolio to hedge against potential risks. The Fed rate cut presents an opportunity for Indian markets, but its long-term effects will depend on both global and domestic economic developments. Read more about Wall St subdued as markets anticipate Fed’s first rate cut in four years.

Thank you for reading. We hope this gives you a good understanding. Explore our Technology News blogs for more news related to the Technology front. AdvanceDataScience.Com has the latest in what matters in technology daily.